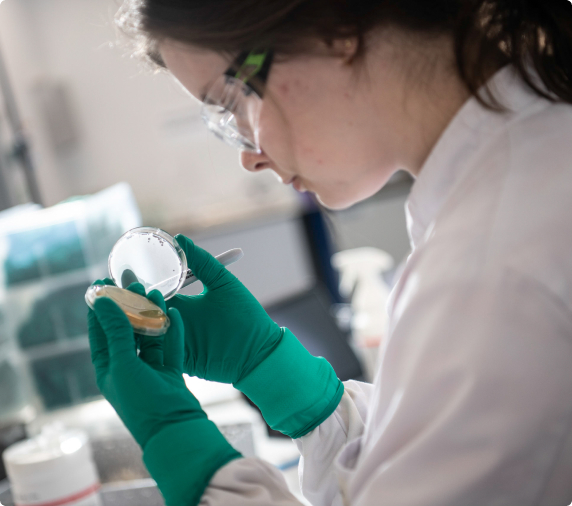

OXB is one of the original pioneers in gene and cell therapy. We’re already collaborating with some of the world’s most innovative pharmaceutical and biotechnology companies towards a shared mission: to make cell and gene therapy a universally accessible clinical option.

0+

Over 30 years of experience

~0

Successful GMP batches

~0

Global active clients

0+

Countries with approved products using our vectors

State-of-the-art facilities in the UK, US, and France

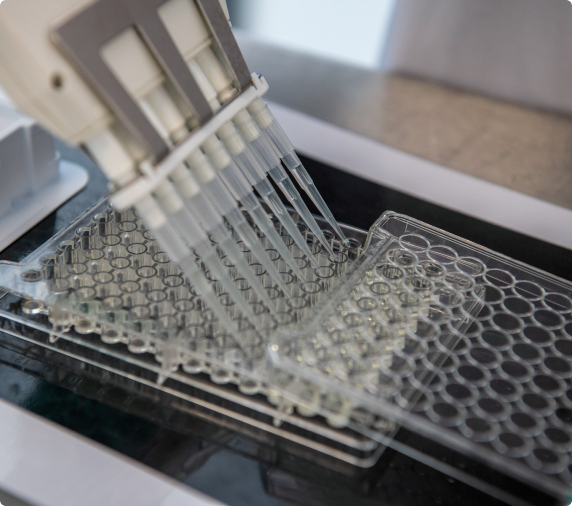

We can accommodate a variety of vector types, processes and batch volumes across our suites in the UK, US, and France. Our state-of-the-art, automated fill-finish facilities package vectors ready for clinical or commercial use. With the addition of the FDA-approved Durham, NC site (drug substance + fill-finish), OXB now offers end-to-end US capabilities supporting late-stage and commercial programmes, particularly in AAV.